7 Easy Steps to a Complete Trading System

With over 22 years of Trading, Investing and Trading Education experience (as of writing this) one thing has consistently stood out when analyzing Stocks to buy or sell.

The price of every stock, every market, every index, commodity and currency will move in cycles.

At times the price moves quite slowly and at others times the price change can be explosive.

The explosive moves tend to be short lived

lasting only a few days.

So there is very little value for profit seeking traders

to hold the position beyond that period.

![]()

|

In this video Tom, explains his approach. |

Explosive price change can happen both on the way up to higher prices and on the way down to lower prices.

Investors for the most part will look for stocks that move towards higher prices, but traders who generally have greater risk tolerance can trade stocks that are declining as well, by selling short.

The purpose of this eBook is to educate traders and investors alike on what I have found to be a simple and quick way to find stocks that are about to have explosive moves and that can potentially lead to substantial profits.

The strategy I am about to explain can also be used to trade options. Due to the short holding periods of stocks that meet the criteria described below, options (calls, and puts) can be an ideal way to trade these.

Technical Analysis

Before we begin it is important to understand the difference between Fundamental and Technical Analysis.

The methods used to analyze securities and make investment decisions fall into two very broad categories: fundamental analysis and technical analysis. Fundamental analysis involves analyzing the characteristics of a company in order to estimate its value.

Technical analysis takes a completely different approach; it doesn't care one bit about the "value" of a company or a commodity. Technicians (sometimes called chartists) are only interested in the price movements in the market. (Investopedia)

Fundamental Analysis

The biggest part of fundamental analysis involves delving into the financial statements. Also known as quantitative analysis, this involves looking at revenue, expenses, assets, liabilities and all the other financial aspects of a company.

Fundamental analysts look at this information to gain insight on a company's future performance. (Investopedia)

Technical Analysis

In other words, technical analysis attempts to understand the emotions in the market by studying the market itself, as opposed to its components. If you understand the benefits and limitations of technical analysis, it can give you a new set of tools or skills that will enable you to be a better trader or investor. (Investopedia)

Fundamental Analysis will look at things like the cash flow, income statement, earnings and management of a company. It will evaluate the company’s products and services in order to determine its future growth and profitability.

By contrast Technical Analysis considers that the ‘fundamental analyzing’ of a company or stock has already been done, and will use tools such as Charts, Indicators and Mathematical Formulas to determine if money is flowing into the stock (prices likely to increase) or flowing out of a stock (prices likely to decrease), and at what rate. (Accelerating or decelerating)

The Tools

Indicators

Charting platforms are loaded with hundreds of indicators used to analyze price movement; fortunately you will not need most of them. In fact my analysis requires only 3 indicators.

Bollinger Band

Bollinger Bands® consist of a center line and two price channels (bands) above and below it. The center line is an exponential moving average; the price channels are the standard deviations of the stock being studied. The bands will expand and contract as the price action of an issue becomes volatile (expansion) or becomes bound into a tight trading pattern (contraction). (Investopedia)

ADX

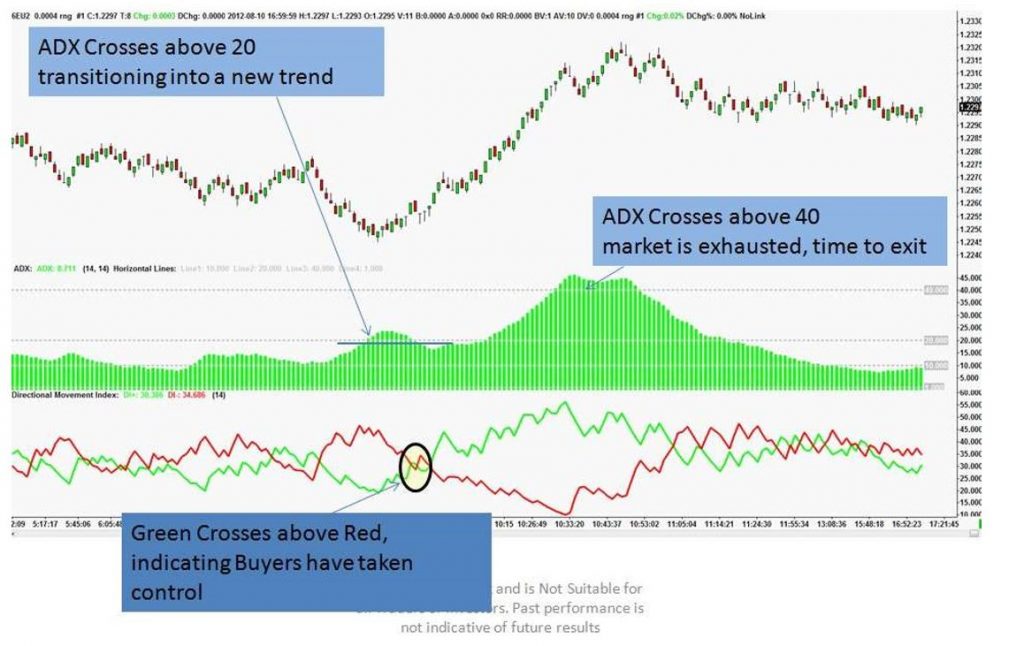

The ADX, which can be used as a standalone indicator to measure the strength of a trend, is also an integral part of the Directional Movement System developed by J. Welles Wilder.

The genius behind the Directional Movement System is that if segments the analysis into 3 components.

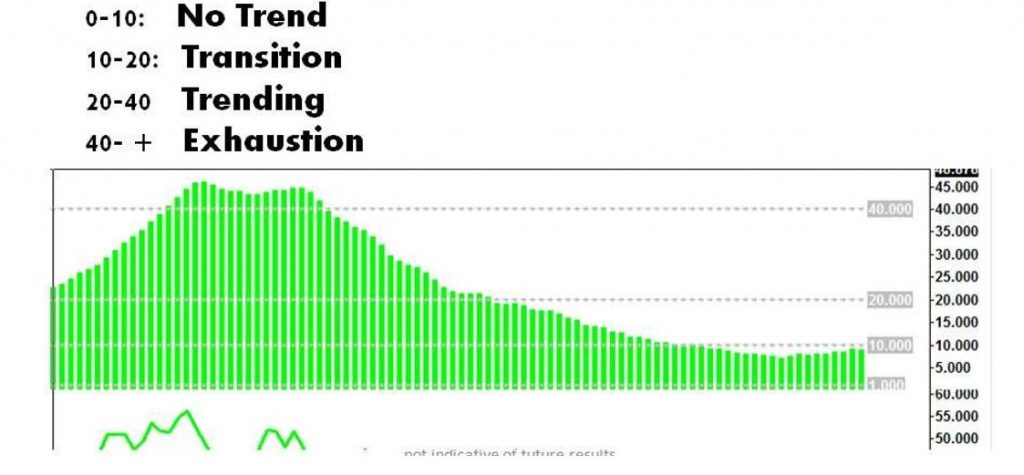

They are ADX: Overall Market Strength This tells us only if the market has ‘energy’ but does not tell us it which direction.

The ADX component can also signal the start of a new trend, or the expiration / exhaustion of an existing trend

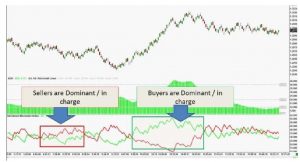

DM + DM-

The 2 DM components which stand for Directional Movement are appropriately labeled DM+ and DM-, and calculate the upward or downward trend movement.

DM+: Measures the strength of the buyers DM-: Measures the strength of the sellers

By comparing the DM+ and DM- the Indicator has a unique ability to measure and summarize both upward and downward movement, and compare them

Use the DM (+/-) To Determine the Trend

DM+ is above: Buyers are in control

DM- is above: Sellers are in control

|

|

USE the ADX to Measure the Strength of the Trend

If doing your own analysis seems daunting, or if you are simply looking for a quicker way to access trades, you may want to consider a 'Done for you' service where analysis and alerts are delivered to you by an expert.

![]()

|

Done for you?

|

The Steps

The Chart

Once your chart is built with the proper indicators in place, it becomes your template, your main work space for performing technical analyses on any stock, index, futures, Forex pair, commodity or currency

The Analysis

Finding the Stocks that are about to Explode.

Now that you have an understanding of the tools you are using, and have configured your chart for analysis, save your chart as a template.

This will allow you to scan through a large number of different stocks without ever having to change the chart itself.

By creating a list of companies or markets that you want to analyze, all you need to do is simply click on the symbol and the chart will update to that particular stock chart.

You can see from the image below that clicking on the symbol for CME, immediately brings up a chart of CME with all the indicators already in place.

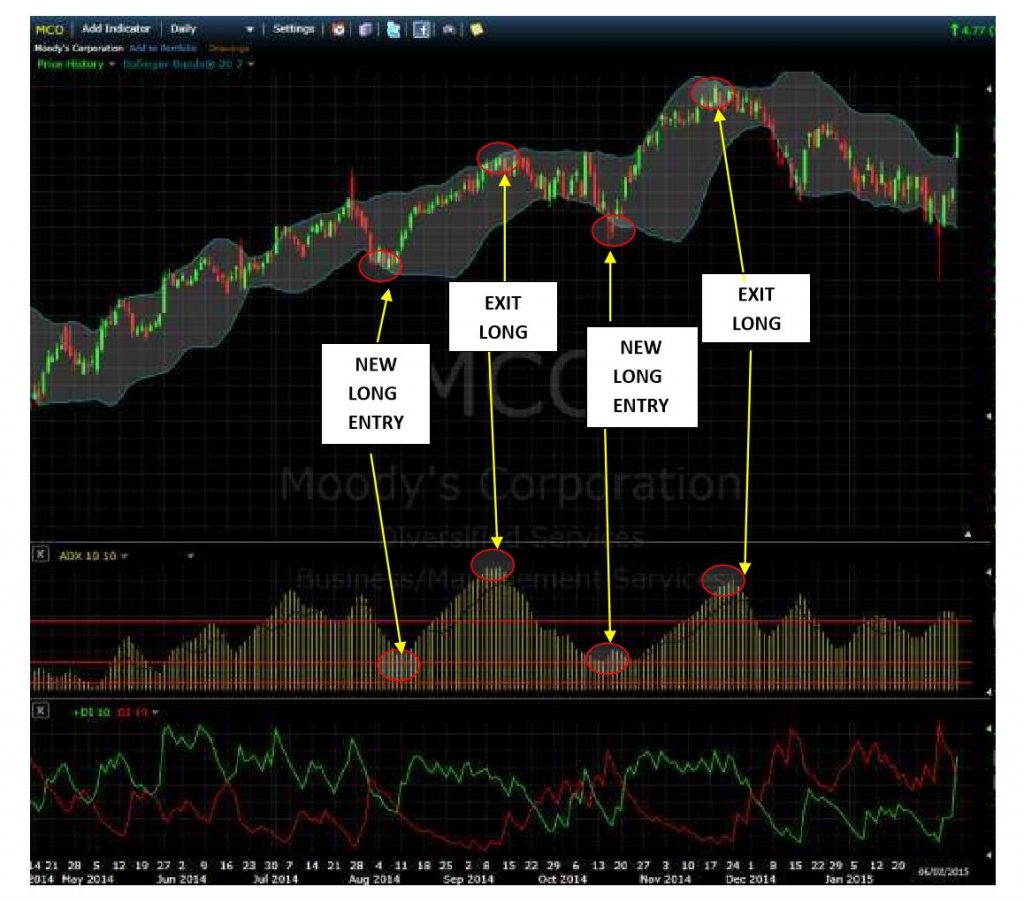

STEP 1: Scan for stocks with a rising Bollinger Band Channel, this indicates that the prices are in an uptrend.

STEP 2: Look for pullbacks to the lower Bollinger Band; this indicates a short term retreat in price in an otherwise Long Trend.

STEP 3: Look for the ADX to Drop below 20 and begin rising again; this indicates that the short term pull back is nearly over and prices should resume moving higher consistent with the longer term trend.

STEP 4: Enter trades as close to the lower Bollinger Band as possible while the ADX is climbing off of 20, e.g. 20-24 range.

STEP 5: Monitor your trade. Never leave a trade without checking on it at least once a day.

STEP 6: Plan your Exit. Exit the trade on exhaustion, when the ADX crosses into the exhausted region, (above 40)

STEP 7: Exit the trade on a failure if the DI- Crosses above the DI+

STEP 8: Always have a stop loss. This is the maximum financial loss you are willing to take on any single trade or position. E.g. if your maximum allowable loss is $1,000 and you have purchased 1,000 shares, then your Stop Loss is a $1 move below your entry price

All of the conditions above can be inverted when looking for short selling opportunities.

Examples

![]()

|

We Call It “The Money Calendar” Watch Tom Live on Camera

|

Disclaimers

All materials in this document or on our website are for educational purposes only. In no event should the content of this website be construed as an express or an implied promise, guarantee or implication that you will profit or that losses can or will be limited in any manner whatsoever. Trading and investing results can never be guaranteed. This is not an offer to buy or sell equities, futures, options or commodity interests. Any results if shown or implied are strictly hypothetical.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR- OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

Earnings Disclaimer: Our website, blogs and emails use affiliate and advertising programs for monetization, which means when you click on ads or links, this can result in a commission that is credited to our company.